Our mission is to build a healthy and stable community by providing financial education, food, and nurturing accountability.

Families join Birch to access groceries and financial education, gain the tools to reduce debt, grow savings, and build toward their unique Family Vision.

EDUCATION

Our Financial Literacy counselors provide tools and support through one-on-one meetings and financial courses.

FOOD

Immediate relief of financial burden creates margin in budget to pay down debt.

LEGACY

Families are able to demonstrate financial stability, break the cycle of poverty, and influence their community and children’s future.

FREEDOM

Families often feel an immediate relief of stress and scarcity, then point towards accomplishing their goals and becoming debt free.

With dignity, accountability, and a strong sense of community, we support families in creating the legacy they want to leave for generations to come.

What we mean by “Family Vision”

The Family Vision is a participant’s personalized roadmap for financial stability, built around what matters most to them. It outlines long-term, values-driven goals such as saving for a home, eliminating debt, or planning for a child’s future, and helps guide day-to-day decisions with clarity and purpose. At Birch, this vision isn’t handed to families; it’s created by them with support from financial counselors who help turn hope into a practical and achievable plan. The process helps partners align priorities, build trust, and work toward shared goals that strengthen the family, serving as both a compass and a motivator for lasting transformation.

How it works…

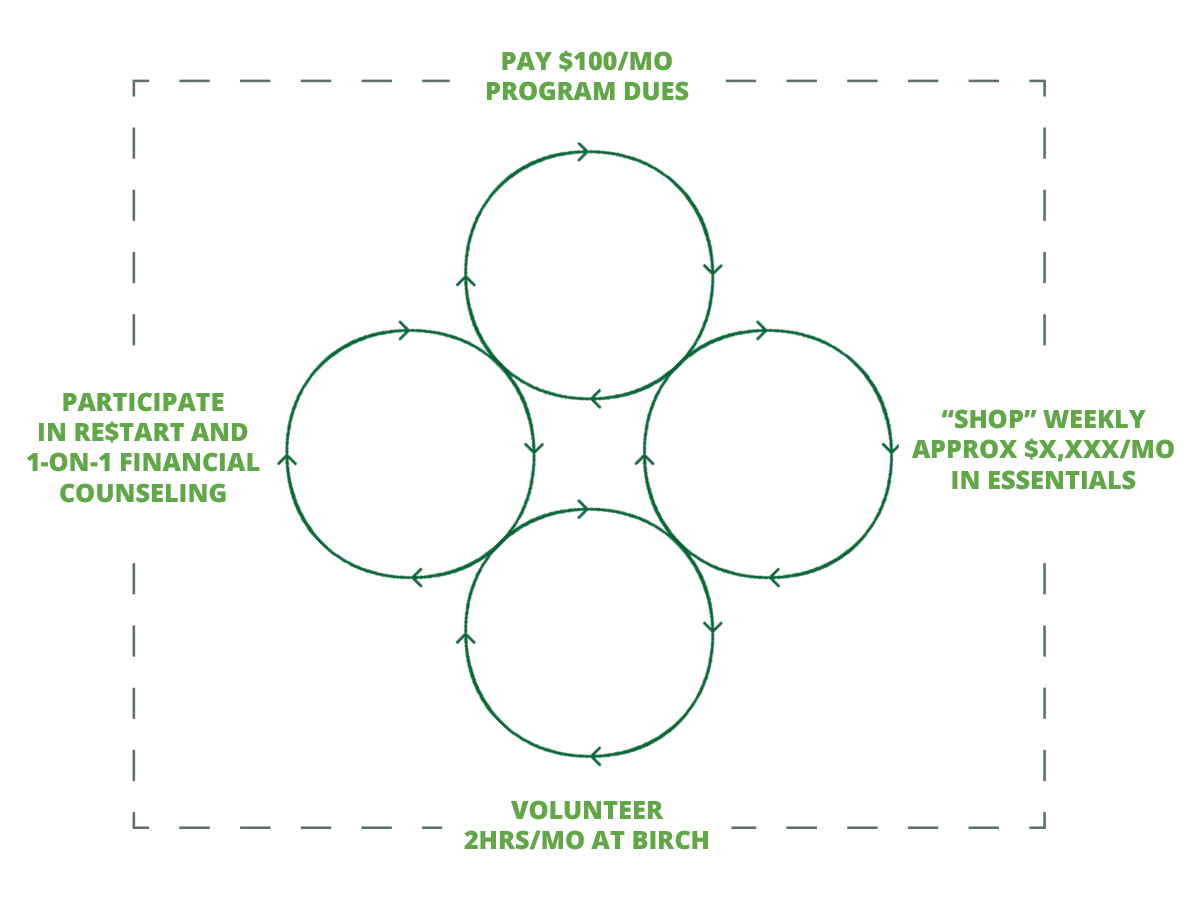

Families who join Birch commit to learning, community, and shared responsibility through monthly dues, volunteer service, financial counseling, and participation in re$tart, Birch’s foundational course on budgeting, credit, debt, savings, and goal-setting.

Participants:

Contribute $100 per month in program dues

Volunteer two hours each month in the warehouse

Meet one-on-one with a financial counselor twice a year

Complete re$tart to build practical financial skills and goals

Participants shop weekly at Birch, receiving about $1,200 in groceries and household goods each month, along with perks such as access to Danner boots, new mattresses, monthly giveaways, and special holiday gifts. They can also take part in workshops that build financial confidence and practical skills.

Financial Literacy:

The Heart of Birch

Every participant begins with a one-on-one meeting with a financial counselor to discuss goals and create a starting plan. From there, families take re$tart, a four-session course that teaches foundational financial tools and helps them shape their own Family Vision for the future.

After completing the course, families meet with their counselor twice a year for follow-up sessions to track progress and adjust goals as needed. Ongoing workshops and specialty classes deepen learning on topics like credit, insurance, and savings—equipping families with the confidence and skills to build lasting financial stability.