Are you cheap? Or frugal?

Merriam-Webster defines a cheapskate as “a miserly or stingy person, especially one who tries to avoid paying a fair share of costs or expenses.”

But what if you’re just trying to reduce your expenses across the board (and not trying to mooch off others)?

Perhaps you’re frugal, which Merriam-Webster defines as “characterized by or reflecting economy in the use of resources.”

Cheapskatery

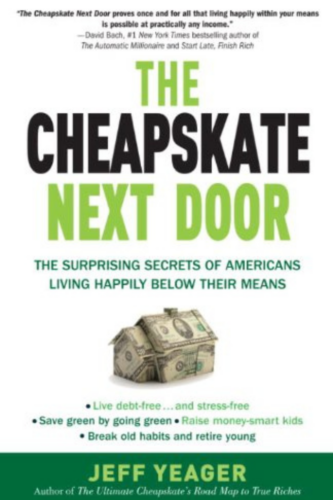

In our collective vocabularies, certain words come with entire backstories of nuance, which these two authors explore.

I’ll warn you here…Jeff Yeager presents being a cheapskate as a positive trait, and he offers–through interviews with avowed cheapskates and through his own personal experience–a wealth of tips for reducing your everyday expenses and living, quite happily, in fact, well below your means.

Jeff makes the case that cheapskatery (by his definition) actually improves your overall outlook on life because you end up being entirely unstressed by money–because your thrifty ways have enabled you to build a satisfactory nest egg and eliminate debt. And he suggests that cheapskatery allows you to be generous to others. Hospitality abounds in his examples.

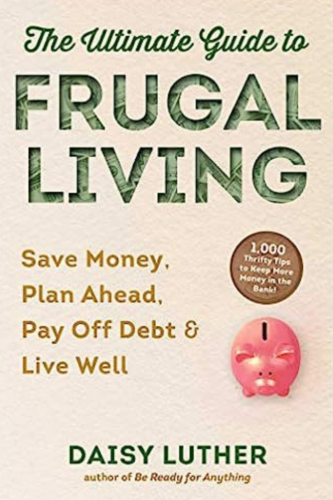

Being Frugal

Daisy Luther takes the frugal approach, primarily through her own story of a personal economic collapse and the tough but valuable actions she took to climb back out of that financial hole, raise her two girls, and live her life to the fullest. Not wealthy, but entirely content.

Daisy’s book, in particular, has some great sections on how to have the tough conversations with the kids you’re bringing along with you on this thrifty path. How to help them know the true cost of the items they ask for, how to help them work for the things they want and manage their own money well, and how to present the bigger picture in ways they can understand.

What both of these authors share, between the lines, is a focus on living their values. Here at BCS, we would say that they’ve developed their Family Visions. And they are using money and time and intentionally developing skills toward the application of those values in their daily lives.

Which is pretty cool. And satisfying. And reduces life regrets down to just about zero.

Final Thoughts:

So I recommend both of these books for the heart they’re aiming at. You’ll have to excuse some of the dated numbers. This is true for any author anywhere–the moment they write, “X item cost $X,” the book is reasonably outdated. Both of these books were written before our most recent bout of rampant inflation, so you can skim the math.

But the principles will always apply, and having personal examples to glean from may inspire you on your own frugality journey.

*Cheapskate Tip #1: Borrow these books from the library 🙂

Tina Birch

Tina is one of Birch’s Financial Literacy Counselors who meet with our participants regularly to discuss how to meet their financial goals. She is also an avid reader and writer so we are excited to have her share her knowledge about financial literacy with us here on The Birch Blog.