The impact of medical debt on an individual is undeniable. Especially so when combined with the medical event itself. So how are medical bills affecting working-class families?

Every week we talk with families who are impacted by the high cost of medical bills that have turned into medical debt. These are hard-working families that have typically had unexpected medical events which led to tests, treatments, and follow-up appointments that all added up to thousands of dollars in debt. Our program works hard to help these families come up with a plan to pay down, and pay off that medical debt through financial counseling, classes, and the alleviation of a major financial pain point…groceries.

Pre-Medical Debt Contributing Factors

Before we can begin talking about medical debt, we first need to understand that the high cost of medical bills can start before someone ever sees a doctor. Millions of Americans avoid going to get care out of fear that they won’t be able to pay for it. In fact, Nearly 1 in 3 Americans say that they have delayed getting care because they were worried about the cost. This allows relatively small medical issues to worsen, leading to more appointments and higher-cost treatments. We also find that many individuals who do go to a doctor, may not follow up on testing and treatments because they can’t afford it. Here are some stats from a study done by Kaiser Family Foundation as quoted by Single Care:

- 21% of adults ages 18-64 have not undergone a medical test or treatment that was recommended by a doctor because of the cost. (Kaiser Family Foundation / New York Times, 2016)

- 32% of adults ages 18-64 have postponed getting medical care they need because of the cost. (Kaiser Family Foundation / New York Times, 2016)

Is Medical Debt Really That Widespread?

Medical debt is not an isolated problem that hits a small subset of individuals. In 2019 we saw that 9% of adult Americans had some form of medical debt. Depending on the demographic being examined this number was as high as 21% (Peterson-KFF, Health System Tracker). And a quarter of these individuals are paying interest on the debt owed (many at a rate of 13% interest!). If that isn’t a shocking enough statistic, let’s look at how many of those individuals and families are dealing with greater medical debt…

In 2019 1% of adult Americans, or 3 million people, had medical debt greater than $10,000.

According to the 2021 census that number rose to 4% of households reporting a high medical debt burden (defined as debt that exceeds 20% of a household’s annual income).

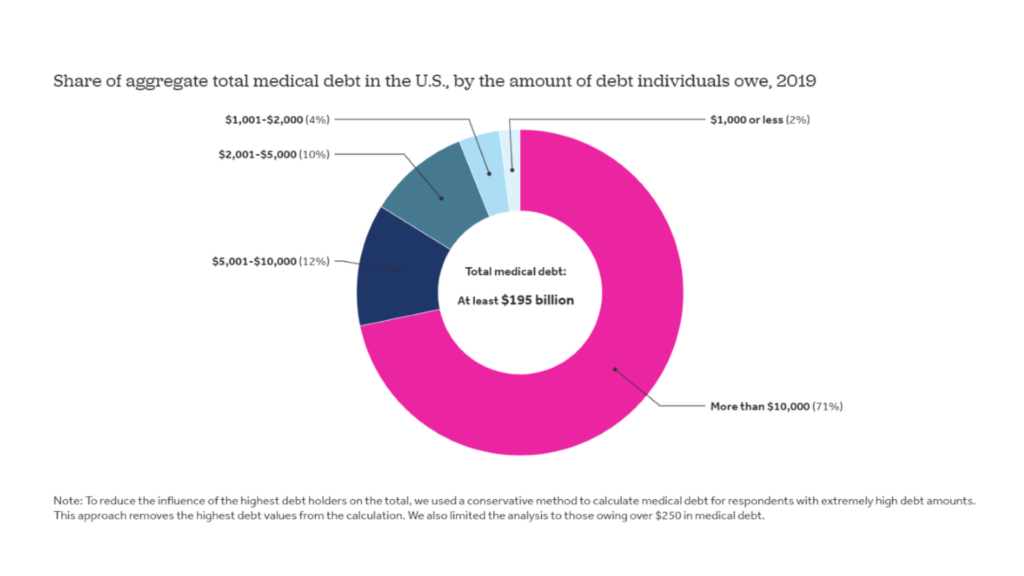

It’s no wonder that medical debt exceeds $195 BILLION in the US, with 71% of that debt being carried by the 3 million individuals experiencing the weight of large (+$10,000) medical debt.

The Inequality of Medical Debt

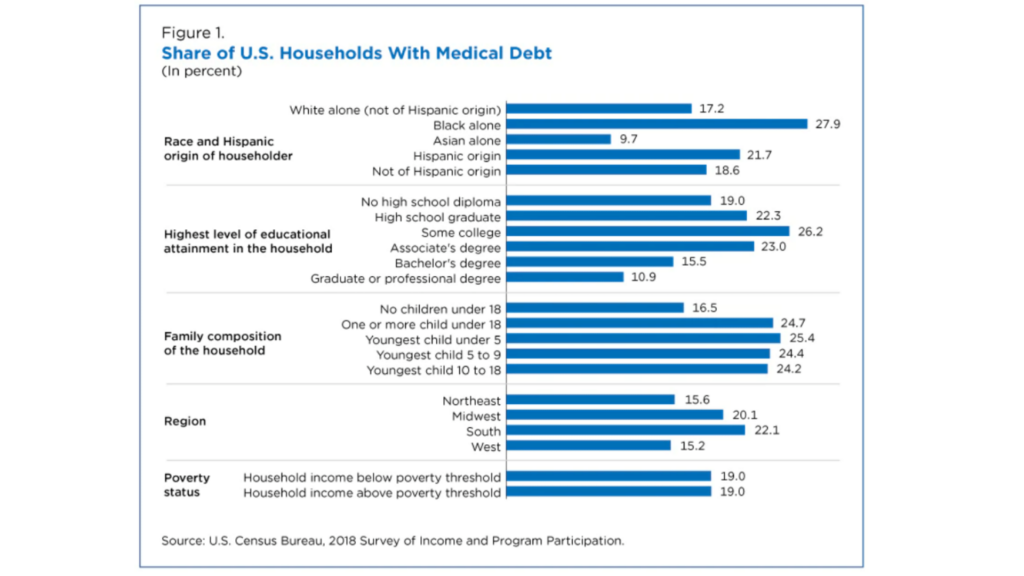

Unfortunately, these statistics aren’t the same for every demographic. We can see from the chart below (provided by census.gov) that medical debt is even more prevalent within:

- black households

- households with some college education (but no degree)

- families with children

How Do Families Facing Life-Threatening Diagnosis Cope?

In 2018 a clinical research study was published in the American Journal of Medicine entitled Death or Debt? National Estimates of Financial Toxicity in Persons with Newly-Diagnosed Cancer.

This study found that of the 9.5 million newly-diagnosed persons with cancer who were ≥50 years of age there was a substantial proportion incurring financial toxicity. The study discovered that 42.4% depleted their entire life’s assets to cover medical expenses. The average losses were $92,098 and financial insolvency was extended to 38.2% of the patients.

“As large financial burdens have been found to adversely affect access to care and outcomes among cancer patients, the active development of approaches to mitigate these effects among already vulnerable groups remains of key importance.” (Death or Debt? 2018)

Is there a Solution to Medical Debt?

We sadly don’t have a solution to the ongoing issue of medical debt, but we strive to help each family that comes through our door not only pay off the debts they have but to be more financially stable so they can weather any future medical storms without going into debt.

If you are interested in partnering with us to help families become financially stable you can do one of the following:

- Donate – $30/month helps to support a family of five in our program

- Volunteer – We are always looking for willing volunteers to help out in our warehouse or in other capacities. Have a special skill that you think we could benefit from? Let us know and we will see how we can partner together!

Maybe this article hit close to home. If you think you might be a fit for our program you can learn more about what we do here.

If you are experiencing medical debt and need an advocate to help you reduce your medical bills we highly recommend you reach out to those at Dollar For.